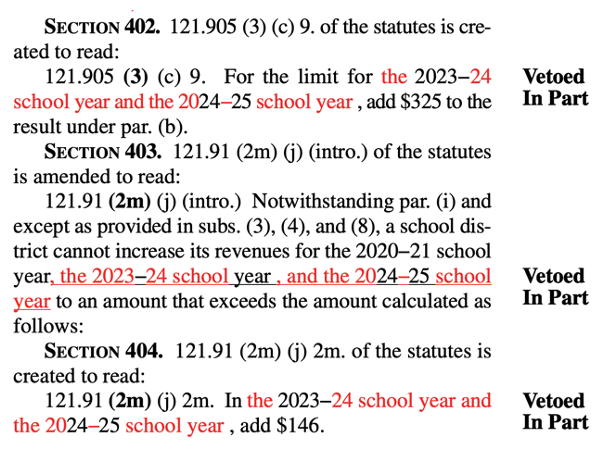

While the Governor’s decision to veto a tax cut for millions of Wisconsinites yesterday has garnered the most attention, slightly under the radar has been another partial veto that the Governor approved yesterday adding money for public schools for more than 400 years. Using great “creativity” with his veto pen, the Governor struck out a provision that added revenue limit authority the 2024-25 school year and replaced it with funding until 2425, or 400 years later. This departure from legislative intent is decidedly undemocratic, though it must be said that Governors of both parties have used the line-item veto in this way in the past. The text of the veto is below. The pieces that the Governor struck are highlighted in red.

Figure 1. Evers Partial Veto on Revenue Limit Authority

But what also must be said is that the implications of this funding increase for the next 400 years are dramatic. In their final budget, the legislature appropriated $325 annually per pupil in increased levy limit authority for both the 2023-24 and 2024-25 school years. This means that school districts will have the ability to raise their levy limit by $325 per pupil enrolled for each school year. This increase is likely partially offset by increases in state aid, but in some districts that receive low levels of state aid it would result in a property tax increase. For context, the average per pupil levy limit in Wisconsin was $11,701 for the 2022-23 school year.

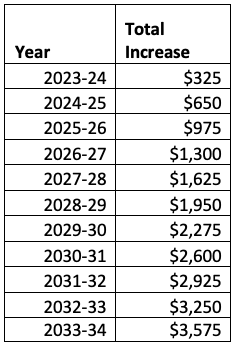

But the Governor changed the end point of that increase from 2024-25 to 2425, a point in time 400 years from now. This means, in the Governor’s words, that districts will receive a “$325 additive increase” in their revenue limit each fiscal year. While this may sound somewhat innocuous, the snowballing effect of this is quite dramatic. The table below shows the per pupil increase from base in just the first 10 years.

Table 1. Total Increase from Base Spending, 2023-2033

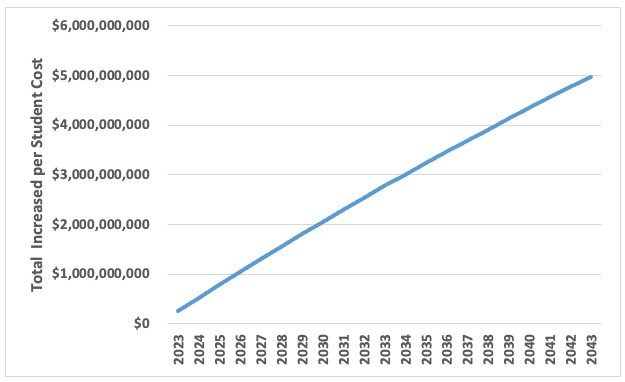

By 2033, spending under the Governor’s partial veto will be approximately $3,575 more than current spending per student. So, given current enrollment in Wisconsin, how much are taxpayers on the hook for? To answer that question, we made public school enrollment projections for the next 20 school years based on the trends observed in enrollment over the past five years. Because of the inclusion of the COVID school year where public-school enrollment fell by nearly 3% in a single year, the estimates here should be considered conservative.

Figure 2. Total New Spending Increases Per Year

By 2043, taxpayers would be required to put nearly $5 billion annually into K-12 public education. In total over this 20-year period, state aid and property taxes collectively are estimated to increase by about $57 billion over current base spending. By about 2070, spending under this partial veto would equal approximately what Wisconsin currently spends between state and local funds on public education. If you project out over the entire time frame of Evers’ increase, we would be spending more than $130,000 more per student than we do today.

It is not clear that this partial veto should withstand judicial scrutiny. In Bartlett v. Evers, Justices Rebecca Bradley and Daniel Kelly made clear that a partial veto is proper only to separate the several proposed laws into one appropriations bill, while Justice Hagedorn and now Chief Justice Ziegler found that it could not be used to “unilaterally create new policies never passed by the legislature.” These were attempts to interpret the Constitution’s statement that a bill may be approved in whole or in part and represent a judgment that the bill may not be turned into something else. Taking an increase in revenue limits passed for a biennium and turning it into a compounding increase over 402 years (or, as a local media outlet put it, essentially in perpetuity” may run afoul of both of these opinions.

In addition, Art. V, sec. 10(1)(c) of the Constitution provides that, in exercising a partial veto, the governor may not create a new word by rejecting individual letters in the words of the enrolled bill ….” The provision may be held inapplicable because a digit is not a letter, but a court may hold that rejecting digits and a hyphen to create a new time horizon is the functional equivalent.

Because this spending is a revenue limit adjustment, how much of it will come from taxpayers via property taxes versus income taxes is still up in the air. While there are many nuances, the state essentially allocates a certain amount of funding each budget to public education, and districts make up the rest via property taxes. But whatever form of taxes this takes, the required increases to fund this will be dramatic and long-lasting.

Of course, inflation will mitigate these numbers to some extent. But the reality is that this veto has saddled countless generations with high funding for a public school system that has been failing Wisconsin kids for generations. In this state, the relationship between spending and outcomes is flat—meaning that on average districts with lower spending do about the same as districts with higher spending. There is no reason to think that this undemocratic action will do anything to improve educational outcomes, but it will perhaps placate teachers’ unions and the public school establishment. Perhaps that was the goal all along. Lawmakers would be wise to quickly consider a veto override of this overreaching action by Governor Evers.