WILL continues to prevail in standing up for choice schools, religious freedom, and the rule of law

The News: Milwaukee County Circuit Court Judge David Borowski granted Wisconsin Lutheran High School (WLHS) summary judgment in an oral ruling on February 2, 2023, ordering a full refund of the 2021 tax assessment plus interest. Following that ruling, the school and the City entered into a settlement agreement refunding the school’s 2022 tax payment and providing for the property’s continued exemption so long as it continues to be used for educational purposes.

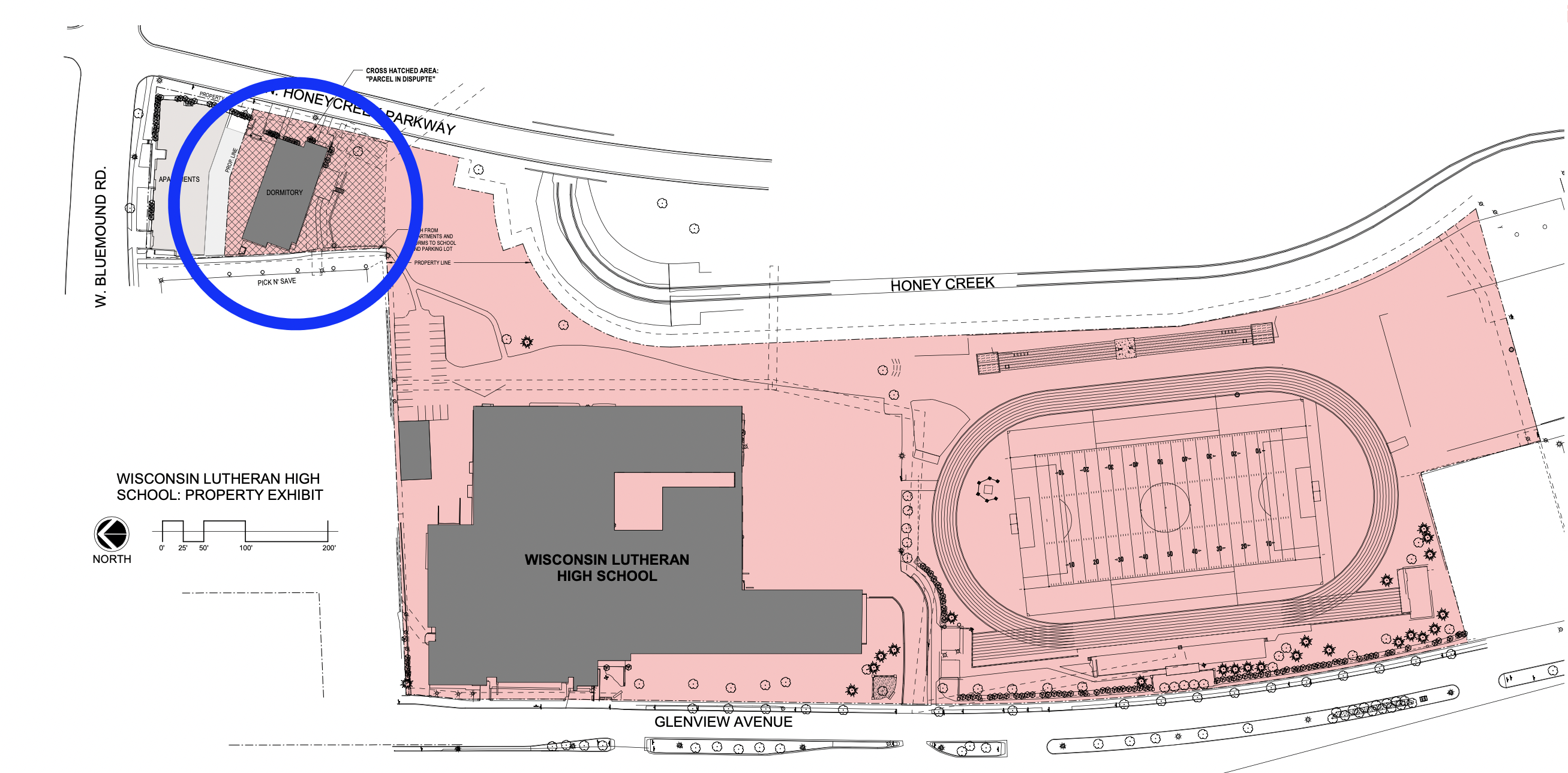

Judge Borowski concluded that the property, which provides student housing as well as an outdoor classroom space and areas for bible study and other activities, was exempt from property taxation as a matter of law. The Wisconsin Institute for Law & Liberty (WILL) filed the lawsuit last summer against the City of Milwaukee on behalf of WLHS, after the City unlawfully assessed the school for over $105,000 in property taxes for the year 2021.

The Quotes: WILL Associate Counsel, Kate Spitz, stated, “Too often religious and private education institutions are targeted by bureaucrats and have nowhere to turn. WILL is proud to stand alongside Wisconsin Lutheran and help secure this long-lasting, generational victory in court. The law is clear, Wisconsin provides property tax exemptions for educational and religious institutions.”

Wisconsin Lutheran President, Rev. Dr. Kenneth Fisher, said, “Our prayers and hard work have been answered with this new court ruling. Thanks to our efforts alongside WILL, these dollars can go towards supporting the education of our students—as they were intended to do!”

Background: Wisconsin Lutheran High School owns property that includes Honey Creek Hall, a building specifically designed for and exclusively used by Wisconsin Lutheran for student housing and educational activities related to the adjacent high school. Despite there being no disputes as to the use of the building, the City rejected WLHS’s exemption application and assessed it $105,946.14 in property taxes for 2021, prompting the lawsuit.

Wisconsin Lutheran is one of the oldest Lutheran high schools in America, with a legacy of providing a quality Christian education to students since 1903. The school is one of the most culturally diverse in the Milwaukee area and emphasizes student development both in academics as well as in servant leadership.

The Ruling’s Significance: Milwaukee County Circuit Court Judge David Borowski granted WLHS summary judgment in an oral ruling, concluding that the property is exempt as property owned by an educational institution under Wis. Stat. § 70.11(4)(a) and would also qualify as exempt as property owned and used exclusively by an educational association under that statute.

Read More:

- Summary Judgment, February 2, 2023