Will Flanders and Libby Sobic

Like an old IPod set on repeat, Milwaukee Public Schools’ attempts to attack and provide misleading data about the Milwaukee Parental Choice Program (MPCP) is a song-and-dance that never stops. In their latest salvo against providing families with educational options, the district included information on the “cost” to Milwaukee residents of the Milwaukee Parental Choice Program (MPCP) with property tax bills. An image of the mailer appears below.

The information on the cards is accurate, as far as it goes. But it leaves out key pieces of information which mislead rather than inform about the impact of this program on the city’s residents.

Overview of the MPCP

The MPCP, founded in 1990, is the nation’s first voucher system for low-income students. Today, students attending a private school on a Milwaukee Parental Choice voucher receive $8,336 per pupil for grades kindergarten through eight, and $8,982 for students enrolled in grades nine through twelve. No public-school student receives funding this low for any students.

In 2021, there were 129 private schools participating in the MPCP with a total enrollment of about 28,770 students. Each one of these 28,000 students live in the City of Milwaukee. With over 100,000 total students in the city of Milwaukee, students participating in the MPCP is still a relatively small percentage of the overall student population. Nevertheless, anti-choice advocates like to claim that the MPCP costs more than it is worth.

The Milwaukee “Funding Flaw”

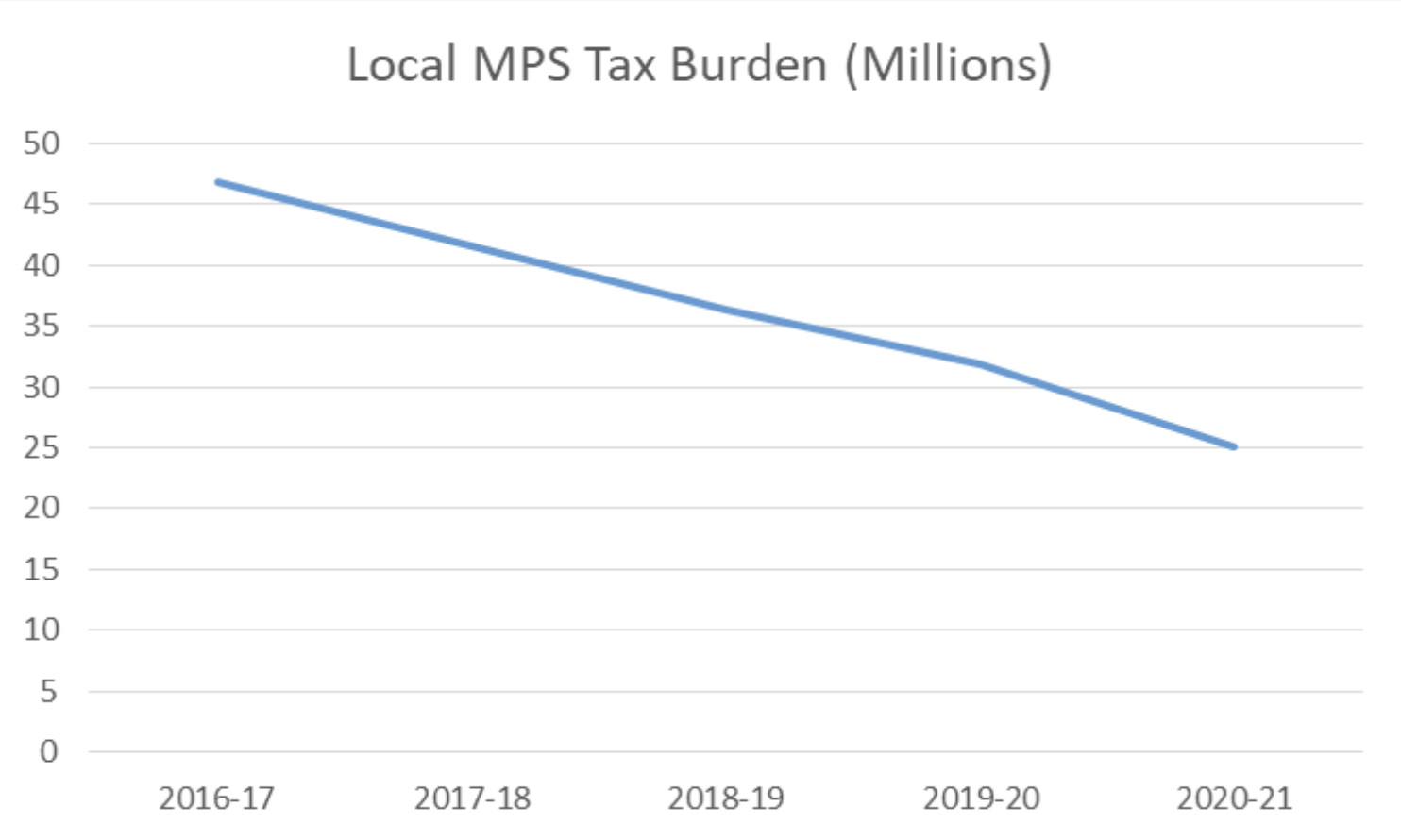

Unlike the Wisconsin and Racine Parental Choice Programs, students in Milwaukee that attend MPCP schools are not counted in the enrollment of the district for revenue limit purposes. This means that the district cannot raise property taxes by including these students in the overall count for its revenue limit. The impact of this requirement shifts the burden for the MPCP partially onto local Milwaukee taxpayers relative to if the students were enrolled in public schools. Some of this deficit is made up in “High Poverty Aid,” but does not cover the loss entirely. For 2021, MPS received $5 million in High Poverty Aid. This reduces the “Funding Flaw” from about $30 million to $25 million, as reported in the mailer.

Fortunately, policymakers in Wisconsin have already taken steps to fix this issue. The amount of aid that local taxpayers are on the hook for continues to decrease by 3.2% every year, until it is fully eliminated by the 2024-25 school year. The table below shows the aid reduction to MPS over the past five years according to the Legislative Fiscal Bureau:

It is important to note that MPS is not required to increase taxes on property tax payers to overcome this funding flaw. In a budget of more than $1.3 billion, $25 million represents little more than a drop in the bucket—funding that could surely be covered through reductions in the bureaucratic bloat of the district. Regardless, the ability for the district to blame families exercising school choice for the high cost of education in Milwaukee is decreasing on an annual basis, and will be completely gone within three school years.

The MPCP actually creates a financial benefit to state taxpayers

The MPCP actually represents a boon to taxpayers statewide. Currently in Wisconsin, no school receiving a voucher receives as much funding as even the lowest funded public school in the state. For this school year, the voucher amount was $8,336 for students in grades K-8, and $8,982 for students in grades 9-12. In contrast, no public school in the state was funded at less than $10,000 per student with state and local funds. This funding difference leads to substantial savings. A 2018 study estimated that the MPCP has saved taxpayers more than $376 million since the inception of the program in 1990.

Finding a new scapegoat

WILL supports making funding equal, regardless of what school door a student walks into. But, until that goal is achieved, school choice opponents will have to look elsewhere to make the claim that choice is not a fiscal benefit to Wisconsin.

Now, more than ever, parents are acutely aware of the high cost and limited benefits of traditional public education. Taxpayers in Milwaukee witnessed schools that kept their doors shut for almost an entire school year despite scientific evidence that reopening schools was safe. In the aftermath of these decisions, proficiency rates in the city reached dreadful new lows that see the vast majority of students unable to read or do math at anything approaching grade level. Rather than focusing on the 1% of K-12 spending that allows families to escape this disaster, Milwaukee families should be asking what the other 99% is being spent on that has led to these results.