By Miranda Spindt

Last week Tuesday, Assembly Republicans passed a bill that would cut income taxes by almost $3 billion for the middle class and retirees. Under the plan, the 5.3% individual income tax bracket, which covers individual income between $27,603 and $304,170, and joint income between $36,840 and $405,550, would be lowered to 4.4%. An additional provision would exempt the first $150,000 of retirement income for those over the age of 67 from income taxes. Republicans plan to use the state’s current budget surplus to make up any revenue shortfall arising from these cuts. After Governor Evers vetoed nearly $3.5 billion in tax relief out of the biennial state budget in July, that surplus for the next budget is currently projected at $4 billion.

But Democrats say that Wisconsin can’t cut its own taxes. Before the announcement of this bill, the Governor’s office recirculated a memo from the Division of Executive Budget and Finance that warns of a claw back of federal relief funds given under the American Rescue Plan Act (ARPA). That law contained a provision stating that states may not “directly or indirectly” use ARPA funds to reduce taxes, and the U.S. Treasury has promulgated a rule that purports to implement that restriction. Evers’ administration estimates that the bill would reduce tax revenue by $2.9 billion and only $627 million in tax reductions would be “permitted” before federal relief funds would be “clawed back.” The Governor is wrong. Courts have held that the statutory restriction – and rule – cannot be enforced.

Congress is granted taxing and spending powers under the Spending Clause of Article I, Section 8 which allows Congress to give money to the states with certain conditions. If states accept the money, they must abide by the restrictions. However, the Supreme Court has made clear that Congress ‘ability to impose restrictions is not unlimited. The nature of these conditions must be “ascertainable,” i.e., Congress must be very clear about how states can meet their conditions so they can make an informed decision to accept the funds. Forbidding states to use ARPA funds to “directly or indirectly” offset loss of tax revenue due to policy changes is vague. States did not know what they could and couldn’t do in exercising their own sovereign taxing powers

Thirteen states sued in the U.S. District Court for the Northern District of Alabama which ruled, in November of 2021, that the rule was unconstitutional because it was “unascertainable” and a permanent injunction was granted that prohibits the enforcement of the rule. While the plaintiffs also claimed that ARPA’s restriction was coercive under the spending clause and violated the anti-commandeering rule (which prevents the federal government from compelling state officials to carry out federal policy), the court concluded it need not address these arguments because the restriction was unconstitutionally ambiguous and unenforceable. This decision was upheld by the Eleventh Circuit Court in January of 2023. A petition for rehearing by the entire Eleventh Circuit was recently denied. It is unclear whether the federal government will seek Supreme Court review.

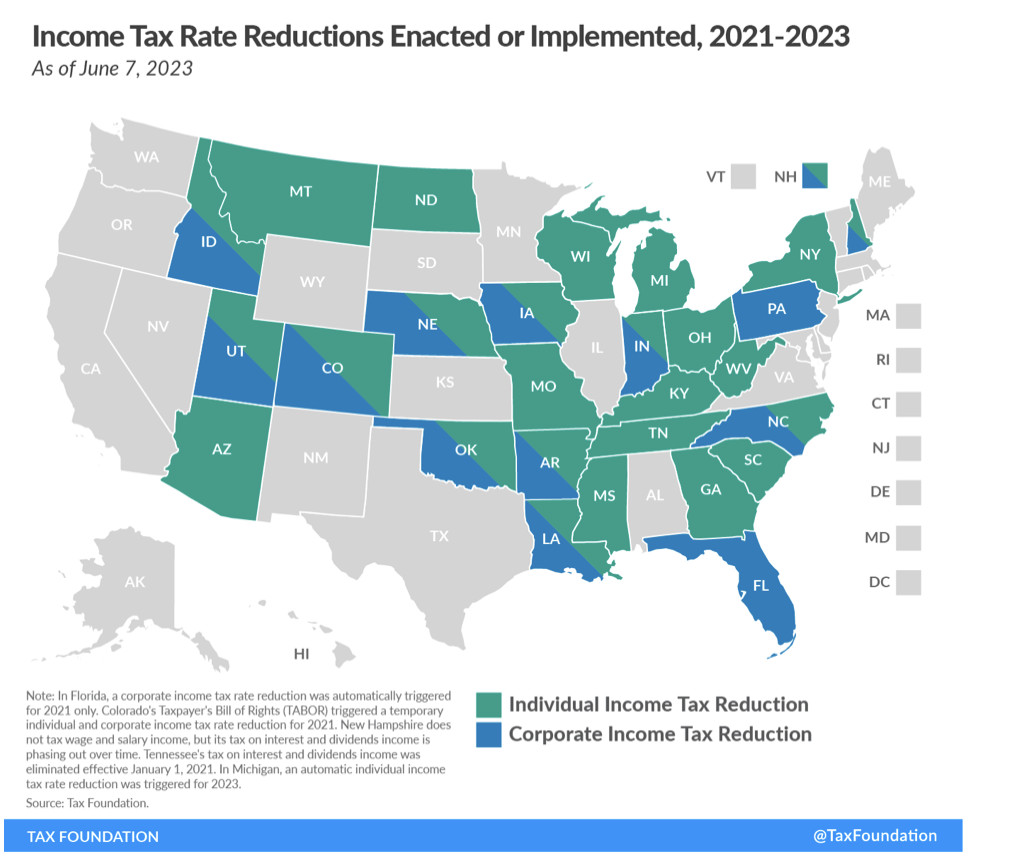

Furthermore, since ARPA’s passage in March of 2021, 25 states have enacted tax cuts for individual income taxes, and 13 states have done corporate income tax cuts. A full map can be seen in the figure below.

With half of US states having tax cuts passed or taken effect with no attempt by the federal government to recuperate state ARPA funds, Wisconsin legislators and Governor Evers should have confidence that they can deliver tax relief to their constituents without fear of retribution from the federal government. Wisconsin’s hardworking families deserve lasting income tax relief, especially considering the state ranks 38th overall in individual income tax burden. Yet, Governor Evers appears to be turning a blind eye to the legal facts, using the threat of a veto to conceal his opposition to returning more of families’ well-deserved earnings. He should reverse course and help make the state more competitive.

With half of US states having tax cuts passed or taken effect with no attempt by the federal government to recuperate state ARPA funds, Wisconsin legislators and Governor Evers should have confidence that they can deliver tax relief to their constituents without fear of retribution from the federal government. Wisconsin’s hardworking families deserve lasting income tax relief, especially considering the state ranks 38th overall in individual income tax burden. Yet, Governor Evers appears to be turning a blind eye to the legal facts, using the threat of a veto to conceal his opposition to returning more of families’ well-deserved earnings. He should reverse course and help make the state more competitive.

Miranda Spindt

Policy Associate