Methodology:

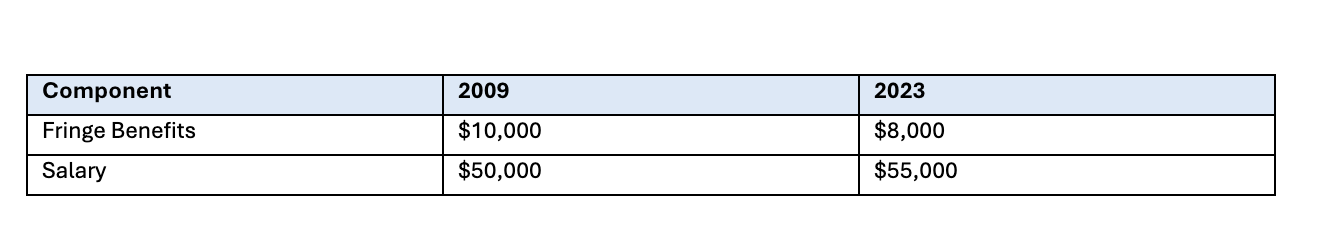

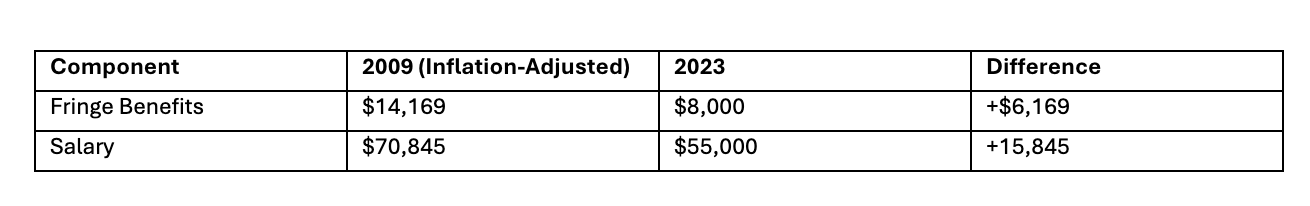

DPI produces an “All Staff” file that provides salary and fringe benefit information for school district employees over time. The key “fringe benefits” that were affected by Act 10 were healthcare and retirement. The law mandated that employees contribute 50% to their pension benefit and 12.6% to the cost of their health insurance. To estimate what would have happened to district costs without Act 10, we take salary and fringe benefits from 2009 per employee and inflation-adjust them to 2024 dollars. The total inflation-adjusted salary and fringe is compared to actual salary and fringe benefits in 2024 to see how much additional costs taxpayers would likely be on the hook for.

Results:

Looking at the aggregate results, we estimate $1.788 billion in new expenses for school districts across the state. This is very close to the $1.6 billion we estimated using an entirely different methodology in our previous work, which supports the notion that the methodology is sound. That work utilized aggregated data from DPI’s financial reports to estimate the change in costs. This work uses data at from DPI’s All Staff file that allows for a more granular look within districts.

$22,014*100FTEs=$2,201,400

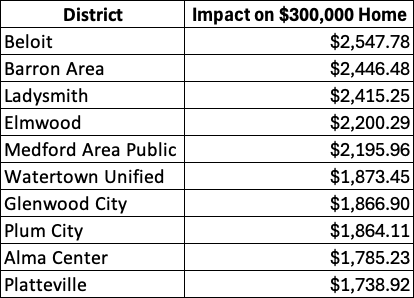

We treat this additional cost as if it were added to the district levy and calculate a new mill rate for the district. Mill rates are calculated by taking the total levy in the district and dividing it by the total property value of the district (excluding TIFs). For the average home in Wisconsin, which costs approximately $300,000, this would mean a tax increase of $624 annually. Results at the district level for each school district are found in the tool below.