6.10.24

In Wisconsin, local expenses for road maintenance are primarily covered by a combination of property taxes, which must adhere to strict state requirements, and state aid. However, municipalities across Wisconsin began trying to use a new method of funding road maintenance, called Transportation Utilities. These utilities charge residents of municipalities a Transportation Utility Fee (TUF), which is in an amount calculated based on how much their particular type of property is expected to generate road usage. For example, a warehouse would use the roads more, and have a higher utility fee, than a single-family home.

Despite this mechanism being called a fee, it is really an unlawful tax. There is nothing in Wisconsin state law which authorizes municipalities to charge a road use fee. Instead, roads are meant to be financed primarily through property taxes which have strict levy limits and uniformity requirements.

The Town of Buchanan was one of the Wisconsin municipalities using a TUF to illegally get around their property tax limitations.

In September 2021, WILL initiated legal action in Outagamie County Circuit Court, seeking a ruling that the Town of Buchanan’s transportation utility fee was unlawful and requesting an injunction to halt its imposition, enforcement, or collection. Judge Mark McGinnis of the Outagamie County Circuit Court ruled during a summary judgment hearing on June 6, 2022, that the transportation utility fee breached the state’s tax limits.

Despite the Town’s appeal, the Wisconsin Supreme Court unanimously struck down the fee as an unlawful tax.

This case has already made big waves as it was used by the Court of Appeals to overrule a TUF in the Village of Pewaukee and demonstrates how our work continuously defends taxpayers around the state.

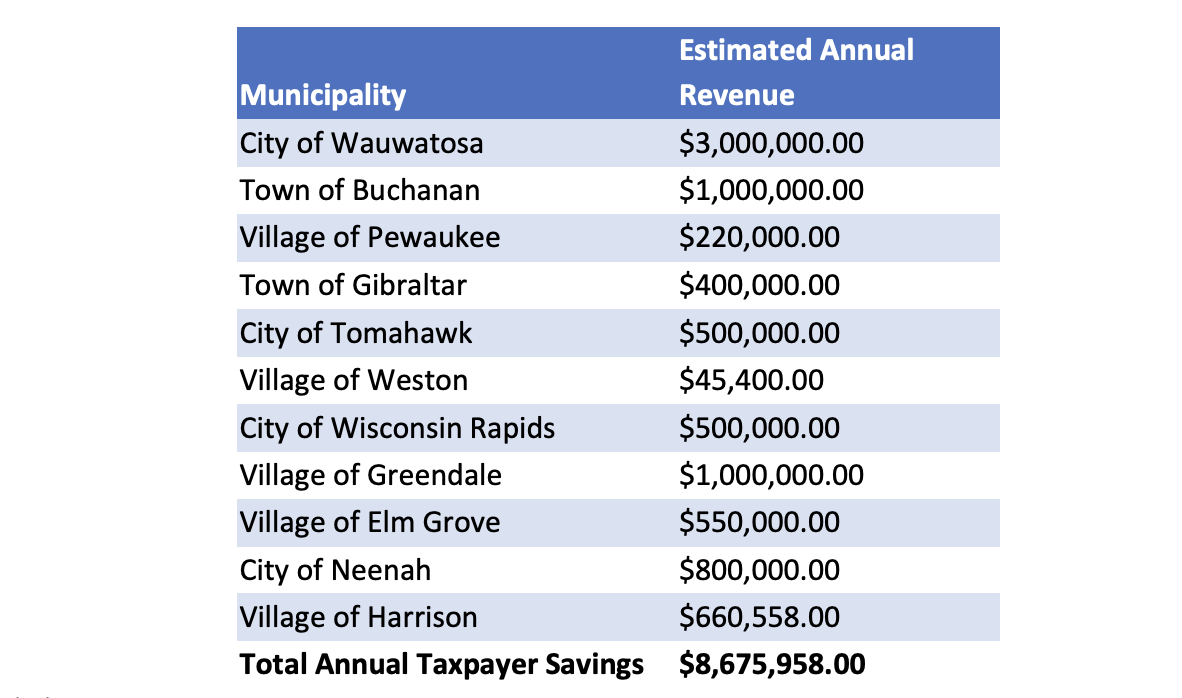

To better measure the impact of our court win, we collected information from municipalities across the state that either considered or implemented a TUF (or something substantially similar). By looking at media reporting and public records, we found 17 municipalities that had either implemented or strongly considered implementing some form of a TUF and have estimated the potential annual taxpayer savings of this win.

- Four municipalities (City of Green Bay, City of Appleton, City of Oshkosh, and City of Clintonville) considered a TUF but did not get far enough in the process to know what the annual revenue would have been.

- Two municipalities had a revenue goal that the TUF would contribute to but was unclear about the TUFs revenue specifically. The City of Hudson planned to implement both a TUF and wheel tax which would have had a combined annual revenue of about $1 million. The City of Watertown had a $40 million revenue goal over a decade which the TUF would have been a part of.

These six cities are not included in our total estimate of taxpayer savings as the projected impact was not specific enough. However, they are still important to highlight as these would have continued the process of implementing a TUF without our litigation, as would have many more municipalities across the state.

The table below contains the remaining 11 municipalities who have either considered or implemented some form of a TUF, and their projected TUF annual revenue. The total cost to taxpayers is an additional $8,675,958 annually.

It’s important to note that not all of these communities have repealed or abandoned their pursuit of a TUF, and some are continuing to collect TUF in some form. However, after the Wisconsin Supreme Court decision in Wisconsin Property Taxpayers Inc. v. Town of Buchanan, any communities that continue to utilize a TUF, or something similar, are at risk of litigation.